The healthcare landscape in the United States continues to evolve rapidly, with major health systems competing for financial dominance. Understanding the revenue rankings of these organizations provides insight into the scale and scope of their operations, as well as trends shaping the industry. This overview highlights the top health systems based on their total net operating revenue for the year 2023, offering a comprehensive look at their financial standings and recent developments.

Many of these organizations have expanded through mergers, acquisitions, and innovative strategies, reflecting a dynamic market environment. For those interested in how technological advancements influence healthcare economics, exploring how artificial intelligence is reducing operational costs in healthcare reveals the transformative potential of AI in streamlining operations. This technological shift is increasingly critical as health systems strive to improve efficiency amidst rising costs.

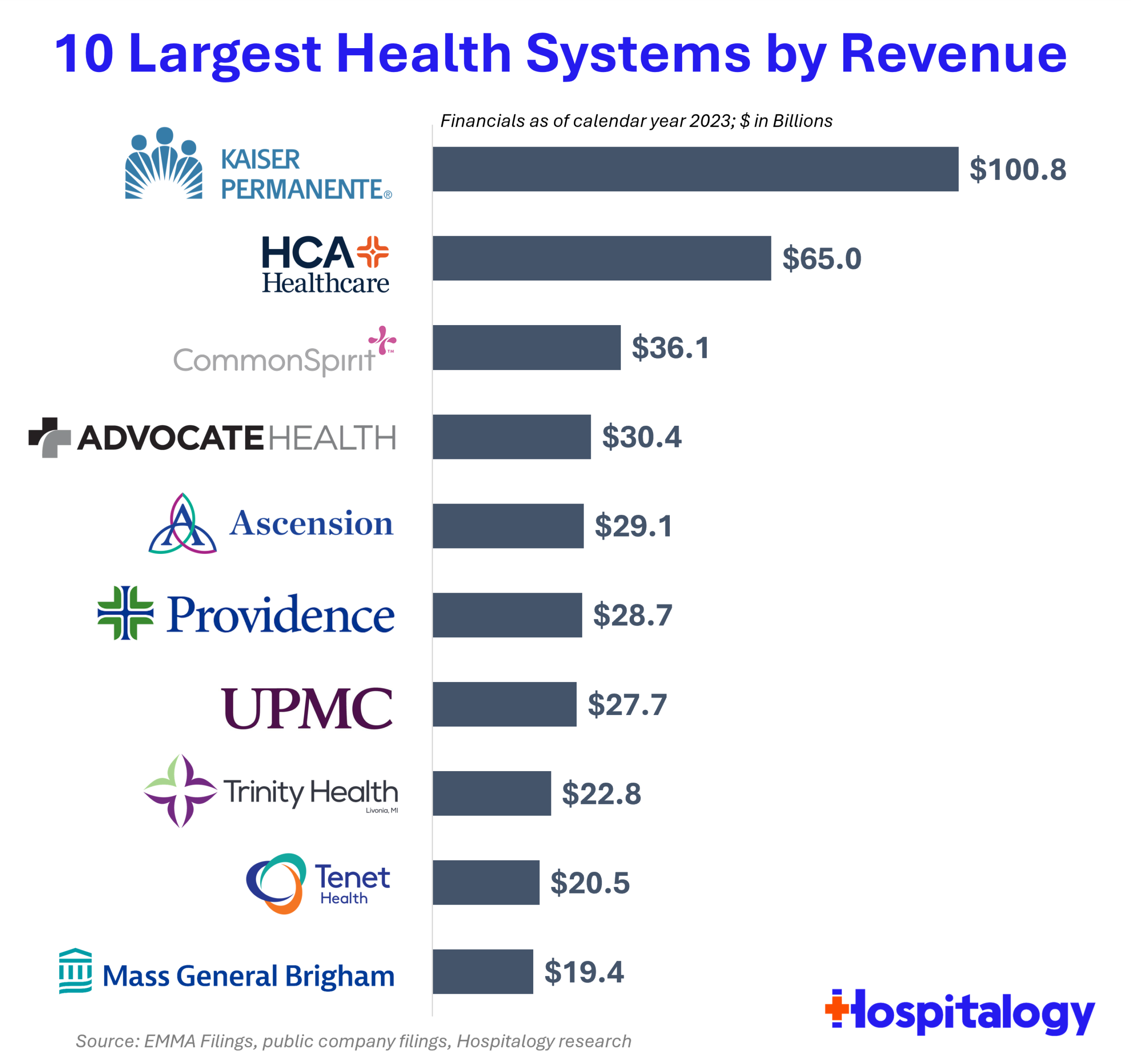

The ranking primarily considers total net operating revenue, which includes income from supplemental payments, research grants, tuition, and premium dollars—beyond just patient care reimbursements. This approach offers a broader perspective on organizational financial health, though it does introduce some variability, especially when comparing systems with diverse revenue streams. Notably, this list does not distinguish between different types of health systems or account for mergers that can significantly alter revenue figures.

Top 10 Health Systems by Revenue

The leading health systems in the U.S. are well-known entities, often recognized for their extensive hospital networks and research capabilities. Kaiser Permanente, although primarily a health plan, also operates hospitals and integrated care models, contributing significantly to its revenue. Meanwhile, HCA Healthcare stands out as the largest standalone hospital operator, often regarded as a pure-play health system with a broad portfolio. As the industry shifts, some players like Tenet Healthcare may see changes in their rankings as they invest more in outpatient services and divest hospital assets.

The list includes many publicly traded and nonprofit organizations that have established dominant market positions. A recent notable development is the creation of Advocate Health through a merger of Advocate Aurora and Atrium Health, which has propelled its revenue toward the $31 billion mark. These large systems exemplify the ongoing consolidation trend, which is reshaping the healthcare landscape.

Interesting:

- Transforming healthcare with 5g technology unlocking new possibilities in the u s

- Leading healthcare giants by revenue a comprehensive overview

- Leading healthcare systems in the united states shaping tomorrows medical landscape

- Why is the u s healthcare system so bad

- Navigating revenue impacts of split shared billing in healthcare

The Full List – 113 of the Largest U.S. Health Systems

The complete ranking of 113 organizations is based on their fiscal year-end financial statements, with data primarily reflecting the trailing twelve months ending December 31, 2023. As the industry continues to consolidate, mergers and acquisitions—such as those in Pennsylvania or Michigan—have significantly impacted the standings. For example, the combined revenues of systems like Froedtert and ThedaCare are projected to surpass $5 billion, while others like Northwell and Nuvance could reach over $19 billion annually.

For a detailed, data-driven view of these rankings, including financial statements and analysis, access to the full Excel data book is available to members of Hospitalogy. If you are involved in healthcare finance or management, understanding these shifts is crucial, especially as decoding the acronym what does app stand for in healthcare can provide insights into digital health strategies driving revenue growth.

Comparing Partial Periods for Systems with June Fiscal Year Ends

Analyzing interim financial performance offers a glimpse into recovery trends post-COVID-19. For health systems with fiscal years ending in June, recent data indicates that all have experienced positive revenue growth during the second half of 2023 compared to the same period in 2022. This suggests a strong comeback as utilization rates rebound, although assessing expense patterns remains essential for a complete financial picture.

Further analysis could involve comparing revenue growth with utilization rates, which are often discussed by payors and risk organizations. Such insights may help predict how large health systems will perform in 2024 and beyond, especially as real-world examples of how AI is used in healthcare become more integrated into operational workflows.

In conclusion, these rankings underscore the ongoing transformation within the U.S. healthcare sector, driven by mergers, technological innovation, and shifting market dynamics. As the industry continues to evolve, staying informed about revenue trends and strategic moves remains vital for healthcare professionals and investors alike. For additional context, explore whether AI is currently being used in mainstream healthcare to understand the technology’s expanding role in driving efficiency and growth.